Navigating SABS Procedures: Insights from Dykeman v. TD General Insurance

Navigating the Nuances of SABS: Insights from Dykeman v. TD General Insurance

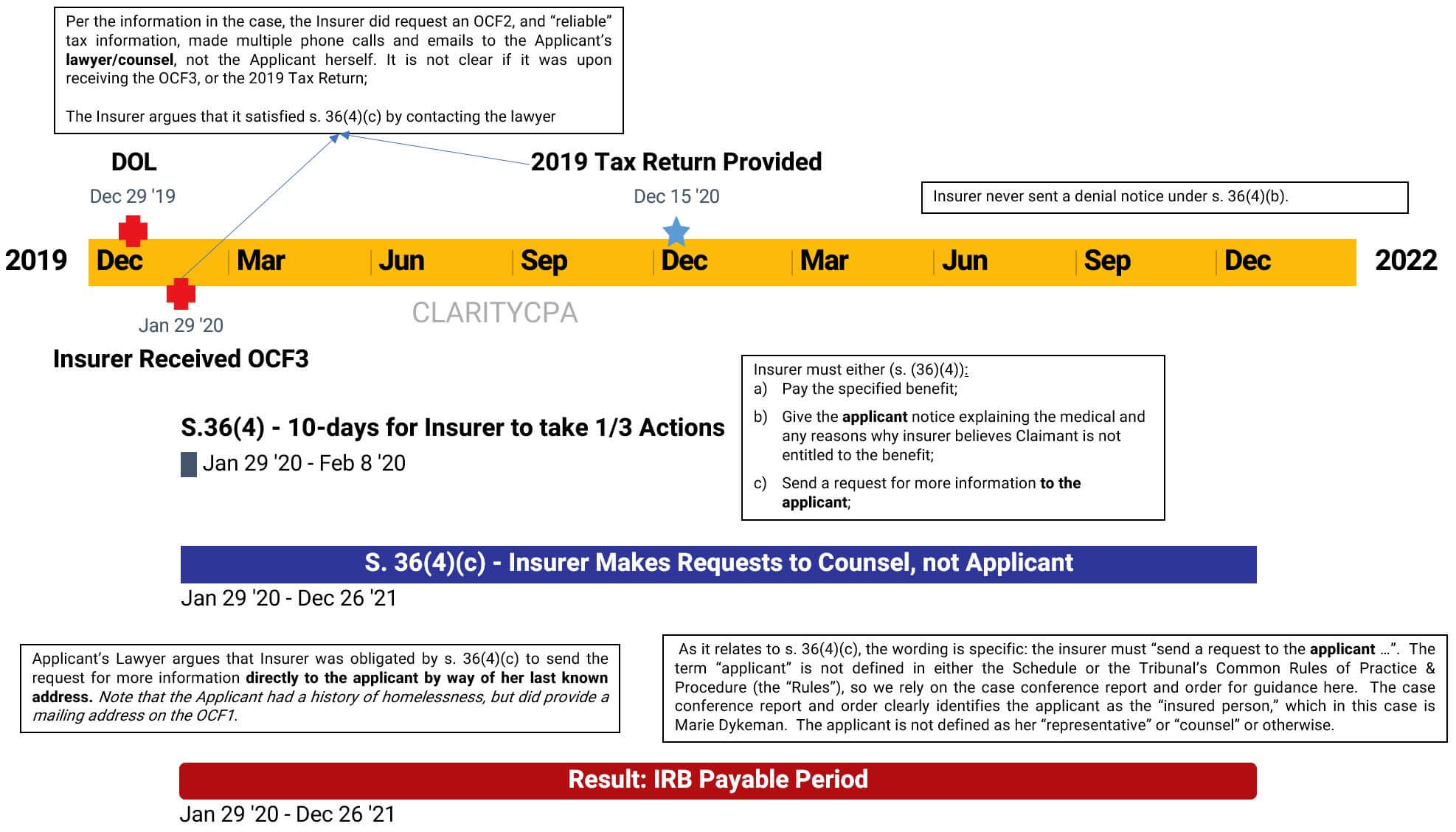

The case of Dykeman v. TD General Insurance offers a compelling exploration into the procedural intricacies of the Statutory Accident Benefits Schedule (SABS). This decision provides a narrative rich in detail regarding the legal steps and requirements involved in the claims process.

Procedural Precision in SABS Claims

The SABS mandates insurers to follow a strict protocol when handling Income Replacement Benefits (IRB) claims. The Tribunal’s findings in this case emphasized the insurer’s deviation from these protocols, particularly after receiving the OCF-3 (Disability Certificate):

“The insurer must: (a) pay the specified benefit; (b) give the applicant a notice explaining the medical and any other reasons why the insurer does not believe the applicant is entitled to the specified benefit; or (c) send a request for more information to the applicant under subsection 33(1) or (2).” (SABS, Section 36(4))

Despite the insurer’s efforts to gather additional income information, such as the OCF-2 (Employer’s Confirmation Form), the Tribunal noted a critical misstep: all requests were sent to the applicant’s lawyer rather than directly to the applicant. This procedural error had a significant impact on the Tribunal’s decision, as it did not align with the direct communication requirement stipulated by the SABS.

The Impact of Direct Communication

The Tribunal’s analysis highlighted the importance of direct communication with the claimant, as required by the SABS:

“We find the insurer failed to satisfy the requirements set out in s. 36(4)(a) and (b)… As it relates to s. 36(4)(c), the wording is specific: the insurer must ‘send a request to the applicant …’.”

The insurer’s decision to communicate solely through the applicant’s counsel, while practical given the applicant’s reported homelessness, was ultimately not in compliance with the SABS. This led to the Tribunal’s conclusion that the insurer was obligated to pay the IRB from the date of the application until a compliant notice was issued.

Lessons from Dykeman v. TD General Insurance

The Dykeman v. TD General Insurance case serves as a critical learning tool for both insurers and claimants, underscoring the necessity of:

- Strict adherence to the SABS’s procedural requirements, especially regarding direct communication with claimants.

- Understanding the impact of procedural errors on the outcome of claims.

- Recognizing the Tribunal’s role in enforcing the SABS to ensure fair treatment of claimants.

- It is interesting to note, that the case only highlights pre-accident income based on a tax return for 2019, and the LAT-case-video-conference was in June-2023.

- There is no mention of tax returns or bank statements for 2019, 2020, 2021, 2022, or 2023 – items that Insurer’s usually consider standard documents to explore a Claimant’s post-accident income (if any).

This case acts as an essential reference for navigating the SABS framework, emphasizing the importance of precision and adherence to the established procedures.

Sorry, the comment form is closed at this time.