Assessing IRB Claims: How the License Appeal Tribunal (LAT) Weighs Shareholder Interests and Work Contributions

In the nuanced world of Income Replacement Benefits (IRB), the case of Sadik Lovic vs. Intact Insurance Company stands as a pivotal example of the complexities involved in determining post-accident income entitlements for shareholders who are actively involved in their businesses. This case delves into the intricate details of how a claimant’s pre- and post-accident income is assessed, especially when shareholder status and operational roles intertwine. The tribunal’s decision in this matter not only sheds light on the interpretation of the Statutory Accident Benefits Schedule (SABS) but also sets a precedent for how similar cases might be adjudicated in the future. Join us as we dissect the tribunal’s findings and reasoning, offering a comprehensive analysis that could influence the landscape of IRB evaluations for accident victims who hold business interests.

THE EMPLOYMENT STATUS CONUNDRUM

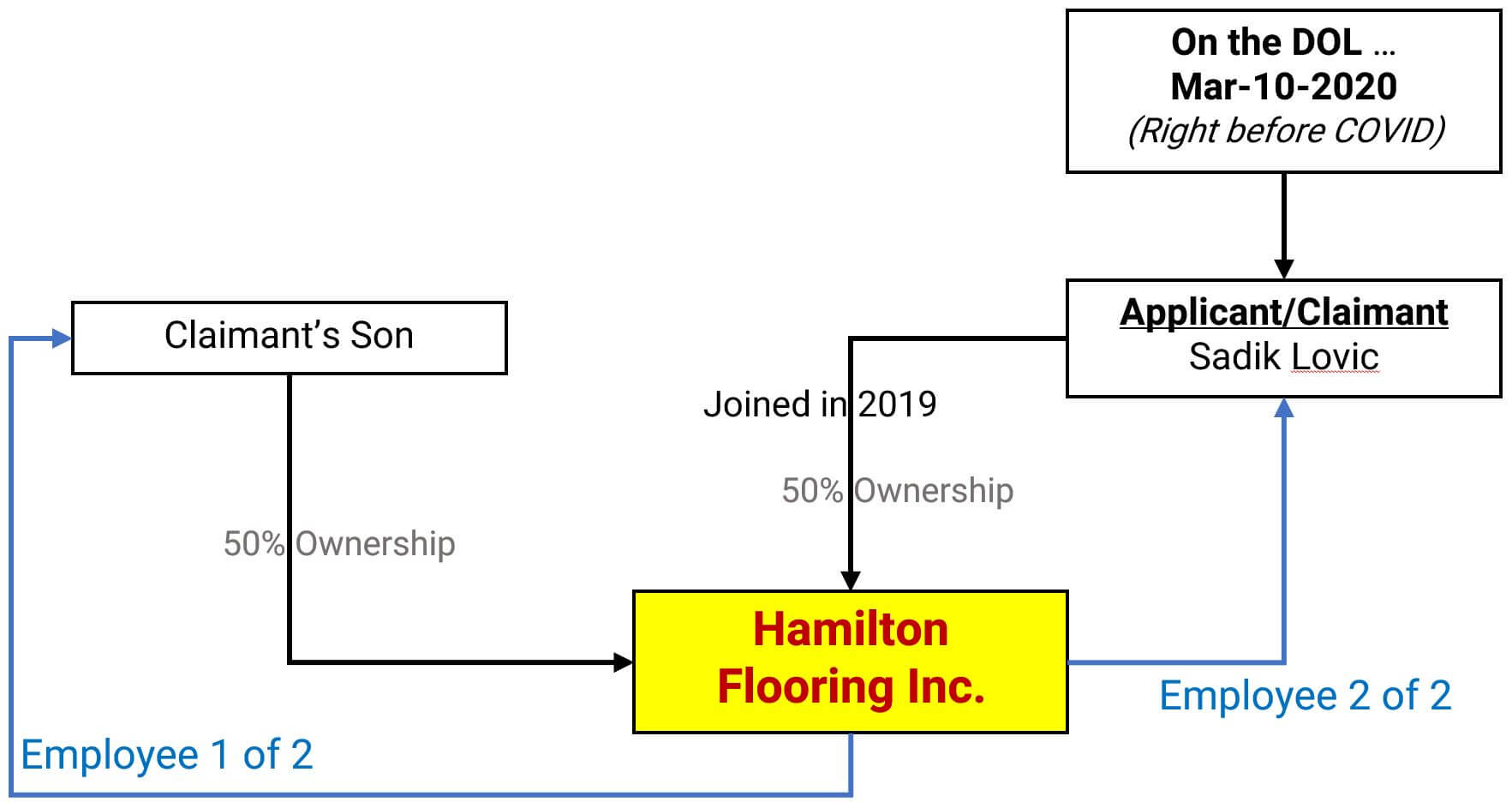

One of the central questions was whether the applicant was self-employed or an employee for the purpose of IRB calculation. The applicant had joined his son’s company, Hamilton Flooring Inc., and was a 50% shareholder. However, the tribunal found that for IRB purposes, the applicant’s status was that of an employee, not self-employed. This was based on the applicant’s reported T4 income and the nature of his work arrangement with the company.

If you were to ask us if the Claimant was self-employed or employed, without having access to the actual supporting documentation or the ability to ask the Applicant any questions… I would conclude that by virtue of owning shares in an active Corporation, the Claimant is definitely self-employed on the DOL.

HOWEVER, did he “complete” a fiscal-year as of the DOL? Unless he joined Hamilton Flooring Inc. on Jan-01-2019, he did not complete a fiscal-year…

This brings up a case, Switzer vs Waterloo Insurance, wherein the Adjudicator used the fiscal year of 2016 to calculate pre-accident income for an accident that occurred in 2018!! This case was centred around the SABS s. 4 wording and meaning behind “the business”. Lookup the case to learn more.

In this case (Lovic), since the Applicant was also a Floorer (i.e. the same business as Hamilton Flooring), it could be argued that he did complete a fiscal year as a “Floorer” in 2019, if he worked as a Floorer from Jan-01-2019 to the date he joined Hamilton Flooring. This type of logic is the same logic used within the Income Tax Act when trying to determine if certain deductions are permissible in specific Corporate-scenarios (that we do not discuss).

So what? Is the Applicant Self-employed? Is the Applicant not Self-employed, and only Employed? Or is the Applicant both Self-employed and Employed? And why is this important?

The applicant and his son, the only employees of Hamilton Flooring Inc., testified they made a verbal agreement to perform equal work for equal pay. In Paragraph 13, the Adjudicator determines that the Applicant is not self-employed based on the SABS’s definition. The Adjudicator’s reasoning appears to hinge on the interpretation of the Applicant’s income sources and the nature of his work arrangement prior to the accident.

How did the Adjudicator conclude on the Applicant’s employment status?

Nature of Income (Paragraph 14): The Adjudicator notes that the Applicant reported income as both an employee (T4 income from Hamilton Flooring Inc.) and as a self-employed person (income from Radnik Flooring) to the Canada Revenue Agency (CRA) in the last completed tax year before the accident. This dual nature of income is important because it influences which subsection of SABS s. 4(2) applies.

Choice of Calculation Method (Paragraph 13): The Adjudicator points out that the Applicant has the option to calculate his IRB based on the last fiscal year of the business that ended on or before the day of the accident (s. 4(2)3) or based on his income for the 52 weeks prior to the accident (s. 4(2)(2)(i)). The use of “may” in s. 4(2)3 indicates that it is not mandatory for the Applicant to use the business’s last fiscal year for calculation if there is a more appropriate method available.

Applicant’s Choice (Paragraph 14): The Applicant chose to calculate his IRB based on his income for the 52 weeks prior to the accident, as per s. 4(2)(2)(i). This is because his income in the four weeks prior to the accident was solely from T4 employment, not self-employment. This decision is crucial because it shifts the focus from the business’s fiscal year to the Applicant’s personal income from employment. It appears that the Applicant not being paid dividends from the Corporation, also was considered.

Employment Status (Paragraph 13): By focusing on the T4 income, the Adjudicator effectively categorizes the Applicant as an employee rather than self-employed for the purpose of the IRB calculation, even though the Claimant holds shares in an active corporation that he also earns T4 employment income from. This interpretation aligns with the Applicant’s reported income to the CRA, which is a key factor in the SABS’s methodology for determining IRBs. i.e. the Applicant earned T4-employment income only in the weeks leading to the accident.

Accuracy of Income Determination (Paragraphs 12 to 16): The Adjudicator prefers the RSM accounting report over BDO’s because it aligns with the Applicant’s reported income to the CRA and does not deduct the business operating results of Hamilton Flooring Inc. from the Applicant’s post-accident entitlement to IRB. This decision underscores the importance of reported T4 employment income in determining the Applicant’s status as an employee, even if they own shares of the corporation.

In summary, the Adjudicator’s conclusion that the Applicant is not self-employed is based on a careful analysis of the Applicant’s reported income types to the CRA and the options provided by SABS s. 4(2). By choosing to calculate the IRB based on the 52 weeks prior to the accident and focusing on T4 employment income, the Adjudicator aligns the Applicant’s status with that of an employee, which is supported by the evidence of how the Applicant and his son operated Hamilton Flooring Inc. and how they were compensated for their work.

THE ISSUE OF POST-ACCIDENT INCOME

The issue of post-accident income in IRB calculations is a critical one, as it determines the extent to which an accident victim is compensated for lost earnings. In the case at hand, the tribunal had to assess whether the applicant, a 50% shareholder in Hamilton Flooring Inc., earned post-accident income that would affect his entitlement to IRBs.

The Insurance Company’s Argument:

The insurer contended that the applicant, despite his injuries, continued to retain a 50% share in Hamilton Flooring Inc. after the accident. They argued that there was no evidence of a verbal partnership or shareholders’ agreement that would substantiate the applicant’s claim of equal pay for equal work. The insurer relied on bank records and financial statements to argue that the applicant’s share of the company’s earnings post-accident should be considered when calculating his IRB, which would result in a lower entitlement or potentially none at all.

The Applicant’s Argument:

The applicant, supported by the RSM accounting report, argued that he did not earn passive income post-accident that should be deducted from his IRB entitlement. He maintained that he and his son had a verbal agreement for equal work and equal pay, and that his involvement in the company was purely operational, without any passive income derived from his shareholder status. The applicant’s tax returns, which did not report additional income from Hamilton Flooring Inc. post-accident, were presented to support this claim.

The Adjudicator’s Decision

The adjudicator carefully considered the evidence, including the applicant’s tax returns, the testimonies of the applicant and his son, and the financial documentation provided. The adjudicator found that the applicant’s tax returns did not report additional income – as wages or profit – from Hamilton Flooring Inc. after the accident. Moreover, the bank records indicated that the applicant reported more income on his tax returns than he actually received, suggesting that he filed taxes based on forecasted earnings rather than actual income.

The adjudicator also took into account the nature of the business and the role the applicant played in it. It was noted that Hamilton Flooring Inc. was a small business where profits were largely dependent on the physical work done by the applicant and his son. The adjudicator found it unreasonable to suggest that the applicant’s entitlement to remuneration from the business was independent of his work contribution, which had ceased due to the accident.

In conclusion, the adjudicator determined that the applicant did not earn passive income from his shareholder status that would affect his IRB calculation. The decision was based on the principle that IRB entitlement should reflect the actual loss of income due to the inability to work post-accident. The adjudicator’s decision highlighted the importance of the factual work contribution over the formal shareholder status in determining IRB entitlements.

This case sets a precedent in several ways:

– Dual Nature of Income: For individuals with both employment and self-employment income, the method of calculating IRBs must consider the nature of income reported to the CRA.

– Choice of Calculation Method: The decision affirms that applicants have the discretion to choose the most favorable calculation method under SABS s. 4(2).

– Evidence of Work Arrangement: The adjudicator placed significant weight on the evidence of how the business operated and how the parties were compensated, which could influence future cases involving family-run businesses.

Potential Impact on Accident Victims

For future accident victims, this case highlights the importance of:

– Accurate Income Reporting: Consistent and accurate reporting of income to the CRA can significantly affect IRB calculations.

– Documentation of Work Arrangements: Verbal agreements or informal work arrangements should be documented to substantiate claims.

– Understanding of SABS Provisions: A thorough understanding of SABS provisions can ensure that the chosen method for calculating IRBs is the most advantageous.

Quick Notes:

| Issue | Insurance Company’s Accountant | Applicant’s Accountant | Adjudicator’s Ruling / Results |

| Dispute relates to IRB calculation (Paragraphs 6 to 11) | The insurer’s accountant, BDO, argued that the applicant’s share of Hamilton Flooring Inc.’s earnings meant he was entitled to $0 per week in IRBs. They contended that the applicant retained 50% of his shares after the accident and there was no evidence of a verbal partnership or equal pay for equal work. They relied on the company’s financial statements and tax returns, asserting that bank records did not show equal pay for equal work. | The applicant’s accountant from RSM contended that the applicant’s IRB should be calculated based on his reported T4 employment income from Hamilton Flooring Inc. and his self-employment income from Radnik Flooring. They argued that the applicant’s income should be considered based on the 52 weeks prior to the accident, in line with his tax filings. | The Adjudicator ruled in favor of the applicant, agreeing with RSM’s report and finding that the applicant’s IRB should be calculated based on his T4 employment income and self-employment income as reported to the CRA. The Adjudicator rejected the insurer’s argument that the applicant’s shareholder status should affect his IRB calculation. |

| Accuracy of income determination (Paragraphs 12 to 16) | BDO suggested that the applicant was not entitled to any IRB due to his shareholder status and the lack of evidence supporting equal pay for equal work. They believed that the post-accident business results of Hamilton Flooring should be deducted from the applicant’s IRB calculation. | RSM maintained that the applicant’s income was accurately reported to the CRA and should be the basis for the IRB calculation. They argued against deducting the business operating results of Hamilton Flooring Inc. from the applicant’s post-accident entitlement to IRB, as the applicant and his son were paid wages, not dividends. | The Adjudicator preferred RSM’s report, finding it to be a more accurate determination of the applicant’s IRB entitlement. The Adjudicator ruled that the applicant’s wages as an employee should be the basis for the IRB and that the business’s operating results should not be deducted from the applicant’s IRB calculation. |

| Post-accident income from Hamilton Flooring Inc. (Paragraphs 17 to 20) | The insurer argued that the applicant continued to earn from his shares in Hamilton Flooring Inc. post-accident and therefore should not be entitled to IRBs or should have them reduced accordingly. They relied on the lack of evidence for a verbal agreement and the bank records to support their claim. | The applicant’s accountant argued that the applicant did not earn passive income from Hamilton Flooring Inc. post-accident and that his IRBs should be calculated based on his actual income reported to the CRA, which did not include post-accident earnings from the company. | The Adjudicator found that the applicant did not earn post-accident income from Hamilton Flooring Inc. and was entitled to IRBs based on his actual reported income. The Adjudicator also ruled that the applicant was entitled to interest on any overdue payment of benefits. |

| Financial Entity | Amount | Time Period | Details |

| T4 Employment Income from Hamilton Flooring Inc. (2019) | $39,540.00 | 2019 | Income reported as an employee of Hamilton Flooring Inc. |

| Self-Employment Income from Radnik Flooring (2019) | $9,322.52 | 2019 | Income reported from self-employment with Radnik Flooring, prior to joining his son’s business. |

| Total Reported Income for 2019 | $48,862.52 | 2019 | Sum of T4 employment income and self-employment income. |

| Hamilton Flooring Inc. Gross Profit (2019) | $101,875.00 | 2019 | Gross profit declared to CRA in the 2019 tax return. |

| Hamilton Flooring Inc. Gross Profit (2020 up to the accident) | $79,317.00 | 2020 (up to the accident) | Gross profit declared to CRA in the 2020 tax return. |

| Applicant’s Employment Income from Hamilton Flooring Inc. (2020 up to the accident) | $7,430.00 | 2020 (up to the accident) | Employment income declared by the applicant for the work completed in the first three months of 2020 before the accident. |

Sorry, the comment form is closed at this time.